Brokers Protected

86% of our loans come from mortgage brokers just like you.

We protect all mortgage brokers by adding your commission to our term sheet and paying you directly at closing, allowing you to focus on growing your pipeline while we handle the rest.

Why you’ll love

working with us

We are a family-owned firm bringing discretionary capital and superior knowledge

to the table, allowing us to quickly close loans regardless of size, location, or complexity.

Direct Lender

QuickLiquidity is a direct lender for all transactions. We have complete discretion over our capital and no outside approval is required for us to close.

Brokers Protected

We protect all brokers who submit deals to us by adding them to our term sheet and ensuring they are paid off the HUD-1 at closing.

Family Business

QuickLiquidity is a family-owned firm. When working with us you'll always be able to speak directly to the decision-makers, not middlemen.

Certainty of Execution

You can have peace of mind when working with us. QuickLiquidity has built a reputation for reliability and has a proven track record of closing loans.

Quick Closings

QuickLiquidity specializes in time-sensitive transactions and can fund even the most complicated loan in as little as two weeks.

Flexible Terms

You tell us what matters the most to you and we’ll create loan terms tailored to meet your individual needs. We care about what you care about.

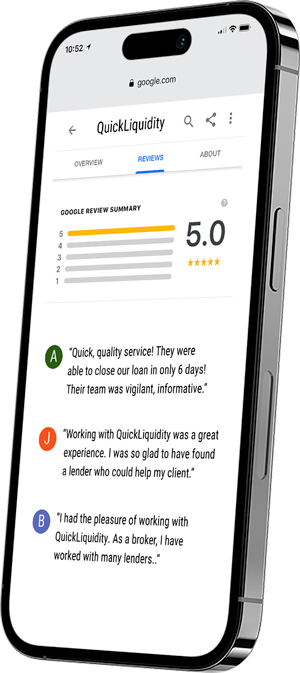

Testimonials

You don't have to

take our word for it

Usually you'd see a creative tagline here created by a marketing team.

Instead, we thought you should hear directly from our borrowers.

"They closed our loan in only 6 days! I’ve worked with many lenders for over 20+ years and this was by far the fastest and most pleasant experience."

Alicia N.

Borrower

"Working with QuickLiquidity was a great experience. I was so glad to have found a lender who could help my client with his short term cash need in such a prompt and efficient manner. As a mortgage banker for 40 years, I can say that I would gladly recommend QuickLiquidity as a reliable source."

Janet P.

Broker

"QuickLiquidity is amazing. They worked Thanksgiving Day and, on the weekend, to close the loan in 5 business days!"

Karen S.

Broker

"I have over 30 years of lending and broker experience. QuickLiquidity has been the most responsive and positive experience I have had with any lender."

Lynn R.

Broker

"Its always a pleasure working with Yoni & his team. Very knowledgeable and a straight shooter. Definitely a great lender to have in your arsenal!"

Nick H.

Broker

"Their customer service is outstanding—every question I have was promptly answered, they take their time to explain the details in a clear and understandable way. I was particularly impressed with how quickly they were able to fund my client's loan. Their speed is a game-changer."

Darrion W.

Broker

"Amazing lender! Closed my deal in less than 15 days, no appraisal. Yoni went extra, extra, extra miles to get this done for me! Really appreciated the professionalism and constant communication! Will definitely do business again!"

Allen W.

Broker

"I had the pleasure of working with Yoni Miller on a deal here in Dallas. He was quick to respond on to all emails and requests, which made for a very smooth transaction and closing!"

Leisa C.

Broker

"They closed our loan in only 6 days! I’ve worked with many lenders for over 20+ years and this was by far the fastest and most pleasant experience."

Alicia N.

"Working with QuickLiquidity was a great experience. As a mortgage banker for 40 years, I would gladly recommend QuickLiquidity as a reliable source."

Janet P.

"QuickLiquidity is amazing. They worked Thanksgiving Day and, on the weekend, to close the loan in 5 business days!"

Karen S.

"I have over 30 years of lending and broker experience. QuickLiquidity has been the most responsive and positive experience I have had with any lender."

Lynn R.

Relationships are the heart of our business.

When working with us you'll always be able to speak directly to a decision-maker, not a middleman.

A. Yoni Miller,

Co-Founder of QuickLiquidity

Three simple steps

to close your loans

Apply

Provide us with basic due diligence to underwrite your commercial property and determine fair market value.

Term Sheet

Review and execute our term sheet which will outline all of the loan terms and costs associated with it.

Closing

Our attorney will draft the loan documents and once signed the funds will be wired directly to your bank.

Recent Closings

Partner with a direct lender

that has a track record of success

Partner with a direct lender that has a track record of success

Dallas, TX

Single Family Home

Property Type

1st Mortgage

Cash-Out Refinance

Arlington, VA

Multifamily

Property Type

1st Mortgage

Cash-Out Refinance

Sarasota, FL

Single Family Home

Property Type

1st Mortgage

Cash-Out Refinance

Frequently Asked Questions

-

Do I have to be approved as a broker to submit a loan request?

No, we do not have an approval process to work with us; we welcome all brokers. Our goal is to make submitting loan requests as simple and straightforward as possible, ensuring your clients can access the financing they need. Whether you’re a seasoned professional or new to the industry, we are here to support you every step of the way.

-

How does QuickLiquidity protect mortgage brokers?

We protect mortgage brokers by ensuring that your commission is included in our term sheet, which is signed by both us and the borrower. When the loan is set to close, we instruct the title company to list your commission on the settlement statement, ensuring you are paid directly at closing. This process eliminates the need for you to chase the borrower for your commission, giving you peace of mind and confidence in getting paid.

-

How much can I earn as a broker?

We do not impose restrictions on how much you can charge the borrower for your services. As long as the borrower agrees to the terms, we will ensure your compensation is protected and paid in full at closing. This allows you the flexibility to negotiate fees that reflect the value you bring to the transaction.

-

What kind of documentation is required to submit a loan request?

The due diligence can vary on a deal-by-deal basis, but we normally request:

- Interior & Exterior Property Photos

- Copy of Lease (if applicable)

- List of Property Expenses (i.e. real estate taxes and property insurance)

- Corporate Documents (i.e. operating agreement)

- Borrower's Personal Financial Statement

-

Do you have a flyer with your full loan guidelines?

Yes. You can download our flyer by clicking here.

-

How long has QuickLiquidity been in business?

QuickLiquidity has been in business since 2015 and has closed transactions across 24 different states, involving over $4 billion in investment real estate. As a family-owned firm, we bring both discretionary capital and deep expertise to every transaction, enabling us to close loans quickly, regardless of size, location, or complexity.

-

What is the best way for me to submit a loan request?

We make it as easy as possible for you to get started. Below are your options:

- Call us right now at 561-221-0881 to speak to a loan officer.

- Apply right now through our online application by clicking here.

- Email us the loan request to team@quickliquidity.com